Pulse on Pay: 12 Years of CEO Pay Long-term Trends in S&P 500 Executive Compensation

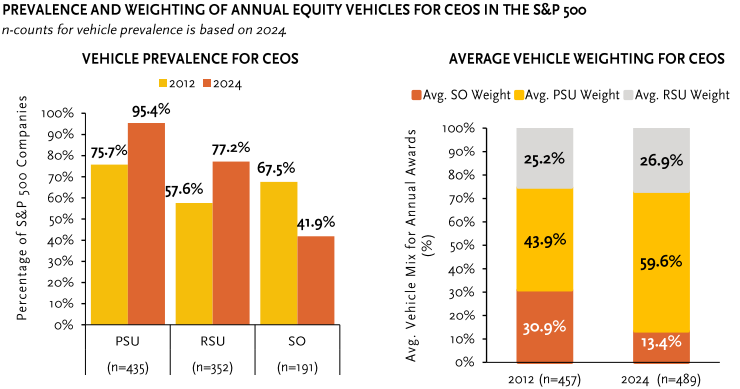

Equity Prevalence and Average Vehicle Mix for CEOs

Key Takeaways: Long-term incentive (LTI) designs have become strongly aligned with institutional investor and proxy advisor preferences through increased performance stock and restricted stock units and reduced stock options. The increase in restricted stock is notable because it is the least intuitively linked to performance of the three vehicles.

We believe the current state reflects the evolution of equity compensation strategies towards a balance of active performance management and risk mitigation.

95% of S&P 500 companies currently use PSUs, up from 76% in 2012 (PSUs represent an average of 60% of CEO LTI mix).

Only 42% of S&P 500 companies currently use options, down from 68% in 2012 (Options represent an average of 13% of CEO LTI mix) 77% of S&P 500 companies currently use RS Us, up from 58% in 2012.

77% of S&P 500 companies currently use RS Us, up from 58% in 2012

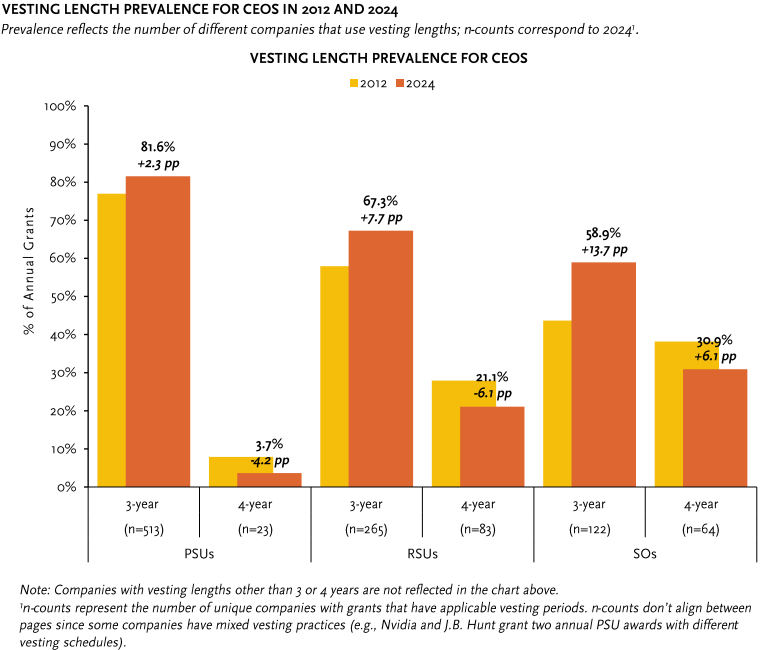

Vesting Length Prevalence for CEOs

Key Takeaways: Over the past 12 years, S&P 500 companies have largely adopted three-year PSUs as the standard for performance-based equity. The vesting schedule of other vehicles has shortened, likely from external stakeholders focusing more on performance stock in their commentary and companies shortening vesting to compel talent. It is our interpretation that pay design has become more short-term oriented as PSUs increased and companies wanted to maintain a competitive edge for talent.

Methodology and Assumptions

This research considers the following assumptions and methodology. Pulse on Pay is published

bimonthly.

- Uses Grants of Plan-based Awards (“GOPBA”) figures categorized as “annual ‘ equity

- The S&P 500 experiences changes throughout the year; therefore, each constituent list is

curated as of 12/31 for each given year (e.g., 2012 fiscal year includes companies in the S&P500 as of12/31/2012) - Excludes partial-year CEO terminations and interim roles

- All data is provided by Main Data Group and reflects pay disclosed through May 2025

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release